3.34 trillion dollars! NVIDIA, the AI giant, surpassed Microsoft and Apple in market value and became the world’s number one | Titanium Media AGI.

Just now, the AI giant (NVIDIA) has set a new record.

At 1 am on June 19th, Beijing time,The share price of NVIDIA (NVIDIA, NASDAQ: NVDA), the world’s largest AI computing power provider and AI chip giant, rose by 3.5% in intraday trading, and its market value reached 3.337(3.34) trillion US dollars, surpassing and becoming the company with the highest market value in the world.

This milestone marks NVIDIA’s outstanding achievements in technological innovation and market expansion, and the importance of the AI era to Wall Street.

3.34 trillion US dollars, equivalent to the sixth largest economy in the world — — Britain’s GDP in 2023 is also the market value of 12 Maotai (1.94 trillion yuan), 25 AMD and 12 AMD, even 8.76 times that of Intel +AMD combined.

So far, NVIDIA has not only become the world’s first chip company with a market value exceeding $3 trillion, the world’s first company with a market value of $3 trillion founded by Chinese, the seventh American company with a market value exceeding $1 trillion and the third one exceeding $3 trillion, but also become the world’s largest AI technology company with the fastest growth of $3 trillion in technology stocks, making history.

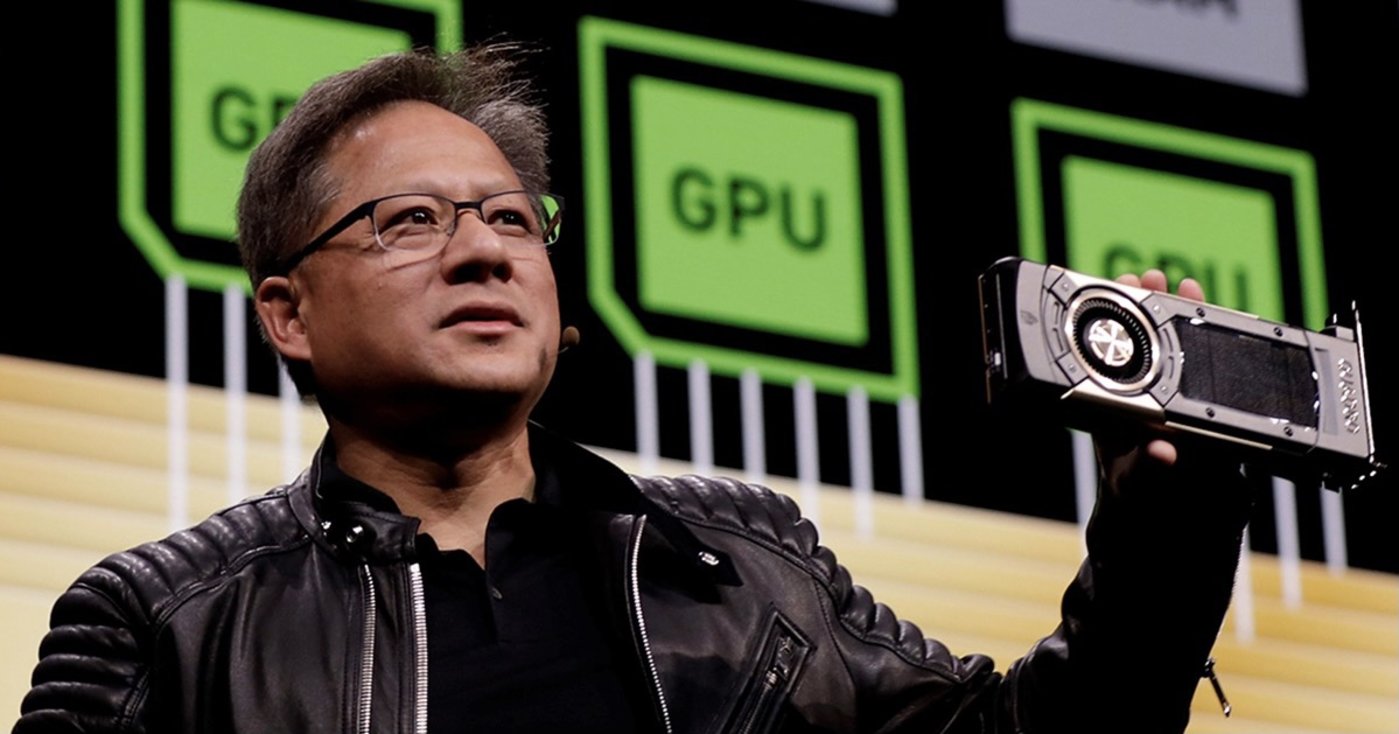

It is reported that,NVIDIA, founded in 1993, is an important innovator in the field of computer graphics and AI technology, and invented GPU graphics computing (accelerated computing) in 1999, which greatly promoted the development of PC game market, redefined computer graphics technology, and initiated a new era of modern AI accelerated computing. In recent years, it has caught up with the meta-universe, cryptocurrency and artificial intelligence, and finally almost unified the AI computing chip market.

Now,NVIDIA has grown into a full-stack computing company, dedicated to developing CPU, GPU, DPU and AI software, providing accelerated computing solutions for data centers, autonomous driving, metauniverse and other fields. At present, in the field of GPU or accelerated computing, NVIDIA has a global market share of over 90%.

In the past, NVIDIA’s share price has recorded a cumulative increase of 10 times, despite the fact that its share price was "halved" twice due to the low tide of encryption digital currency, the "headwind" of macro economy in 2022, the sharp drop in consumer electronics market demand and the downturn of semiconductor industry.

Since November 2022.OpenAI company released AI ChatGPT, which quickly swept the world, and set off a competition and upsurge around AI big model.

As the "overlord" of AI’s bottom computing power, NVIDIA is one of the biggest beneficiaries of this upsurge, and its GPU products have few substitutes in large-scale model training. As the AI "arms race" between companies such as Microsoft and Google heats up, NVIDIA’s A100 and H100 chips have become "hard currency" for large-scale model training.

In March this year, Huang Renxun, founder and CEO of NVIDIA, said that NVIDIA AI supercomputer DGX was the engine behind the big model, and he personally handed over the world’s first DGX to OpenAI. Since then, this product has been installed in half of more than 100 head enterprises around the world.

According to UBS analysts’ estimates,About 10,000 NVIDIA GPUs are needed to develop ChatGPT.

At the same time,NVIDIA’s share price also began to recover continuously due to the AI craze, rebounding from the low of around $112 in October 2022 to the current level of over $400. The AI craze is also stimulating investors’ longing for NVIDIA, and the first-quarter financial report of NVIDIA released this month has pushed up the share price.

On May 22 this year, NVIDIA released the second quarter revenue forecast that exceeded market expectations, and announced a stock splits plan-each share will be split into 10 shares. This series of positive news has greatly enhanced investors’ confidence in this leading enterprise in the field of artificial intelligence and encouraged them to continue investing. Since the beginning of the year, NVIDIA’s share price has risen by more than 170%, and in 2023, it led the Standard & Poor’s 500 Index with an increase of 238.9%.

The growth rate of NVIDIA’s market value is amazing.

Looking back on the scene a year ago, the company’s market value is far from reaching the threshold of $1 trillion, ranking behind the technology giants such as Google’s parent company Alphabet, Amazon, Apple and Microsoft. In the ranking of giants in the technology industry, NVIDIA’s market value is only slightly higher than Meta and.

However, fast forward to June 13, 2023, the market value of NVIDIA crossed the important threshold of $1 trillion in one fell swoop; On February 23, 2024, the company’s market value broke through the $2 trillion mark at an alarming rate, setting a record for the fastest growth from $1 trillion to $2 trillion.

On June 5th this year, NVIDIA’s market value leapt again, breaking through the $3 trillion mark. It took less than four months to leap from 2 trillion to 3 trillion.

Earlier this month, the market value of NVIDIA surpassed that of Apple for the first time since 2002, and the rankings of the two companies have risen alternately in recent days. Last week, Apple once surpassed Microsoft to take the top spot.

As of Monday’s close, NVIDIA’s share price has risen by more than 160% since 2024, and its market value has increased by more than 2 trillion US dollars.

At present, the market value of three companies in the United States has exceeded $3 trillion, namely NVIDIA, Microsoft and Apple. The combined market value of the above three companies is nearly 10 trillion US dollars.

The growth of NVIDIA means that AI is the focus of many investors.

Daniel Ives, an analyst at Wedbush Securities, wrote in a report: "We believe that in the coming year, NVIDIA, Apple and Microsoft will become the focus of competition for the $4 trillion market value of the technology industry."

Huang Renxun, an investor and CEO of NVIDIA, believes that NVIDIA is not only a chip manufacturer, but also a key company in the field of AI infrastructure. Last year, the sales of AI chips in NVIDIA increased by more than 125%.

Michael Lippert, vice president and portfolio manager of Baron Capital Inc, pointed out that "they sell not only chips, but also systems", and pointed out the company’s proprietary software and development ecosystem.

Ives said: "With the smooth progress of the fourth industrial revolution, more and more enterprises and consumers have quickly embarked on this road. NVIDIA’s GPU chips are essentially new gold or oil in the field of science and technology."

Rosenblat Securities analyst Hans Mosesmann even raised NVIDIA’s target price from $140 to the highest price on Wall Street of $200 on Tuesday.Thereby pushing its market value to nearly $5 trillion in the next year.. Moseman stressed: "We expect that the software business will grow significantly in the next decade in terms of the overall sales portfolio, and the valuation of NVIDIA will show an upward trend due to sustainability."

Not only NVIDIA, but also Huang Renxun’s personal wealth has increased dramatically with the soaring stock price.

According to Bloomberg’s real-time ranking of global billionaires, as of June 18th, Huang Renxun ranked 12th in the list, with a total net worth of $115 billion.It surpassed Zhong Shanshan, founder of Nongfu Spring (US$ 60.3 billion, ranking 23rd), Huang Zheng, founder of Nongfu Spring (US$ 52.3 billion, 26th), Ma Huateng (US$ 43.9 billion, 28th), Zhang Yiming, CEO of ByteDance (US$ 42.2 billion, 31st) and Ma Yun (US$ 31.9 billion, 51st), second only to Warren Buffett (1355).

According to documents disclosed by NVIDIA, Huang Renxun, CEO of NVIDIA, sold 240,000 shares on June 13th and 14th at a price ranging from $127 to $133, and Huang Renxun is expected to sell 120,000 shares of the company on Monday. Based on the comprehensive calculation, Huang Renxun sold more than $32 million in cash.

According to the data compiled by Washington Service, excluding the impact of the 10-share split on June 10th, in the first half of this year, NVIDIA executives and directors, including Huang Renxun, have sold more than 700 million US dollars, the highest number of shares sold in six months since the first half of 2023.

(This article first appeared in Titanium Media App, author | Lin Zhijia, editor | Hu Runfeng)