RMB is becoming more and more international! The proportion of foreign exchange reserves in the world has reached a new high.

Beijing, August 15th (Reporter Li Jinlei) The RMB is becoming more and more international!

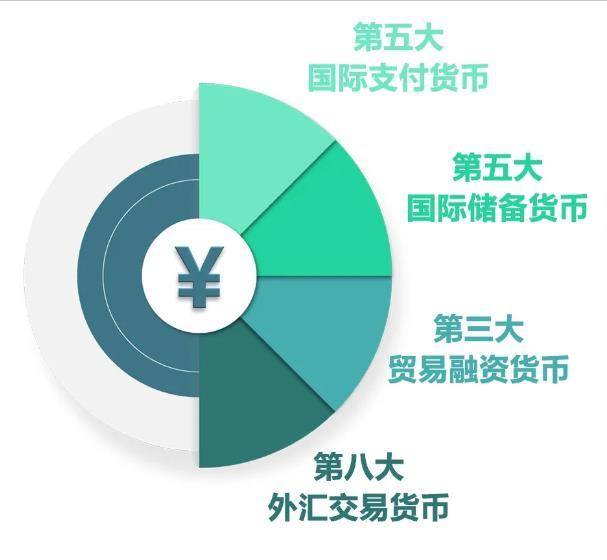

The fifth largest international payment currency, the fifth largest international reserve currency, the third largest trade financing currency and the eighth largest foreign exchange transaction currency … … This is the RMB!

From WeChat official account, the central bank.

The fifth largest international payment currency

On August 14th, the central bank released the Report on RMB Internationalization in 2020, and RMB internationalization reached a new level in 2019. According to the latest statistics, RMB ranks fifth among the major international payment currencies, with a market share of 1.76%.

According to the report, the cross-border use of RMB increased rapidly against the trend in 2019. The total amount of cross-border payment and receipt of RMB by banks on behalf of customers in the whole year was 19.67 trillion yuan, up 24.1% year-on-year. On the basis of the rapid growth in 2018, the amount of payment and receipt continued to maintain rapid growth, reaching a record high.

The fifth largest international reserve currency

According to the official currency composition (COFER) data of the International Monetary Fund (IMF), by the end of the fourth quarter of 2019, the scale of RMB reserves reached US$ 217.67 billion, accounting for 1.95% of the total foreign exchange reserves in the indicated currencies, ranking fifth, surpassing Canadian dollars by 1.88%, which is the highest level since the IMF began to publish RMB reserve assets in 2016.

According to incomplete statistics, at present, more than 70 central banks or monetary authorities around the world have included RMB in foreign exchange reserves.

In the first quarter of 2020, the share of RMB foreign exchange reserves announced by IMF further rose to 2.02%, the highest level since RMB joined the SDR (Special Drawing Rights) currency basket in 2016.

Currency data map.

The third largest trade financing currency

The attraction of RMB as an international financing currency is gradually emerging.

According to the report, the survey shows that about 82% of the overseas industrial and commercial enterprises surveyed said that when the liquidity of international currencies such as the US dollar and the euro is relatively tight, they will consider using RMB as the financing currency, which has reached a new high since 2016. 75% of the overseas industrial and commercial enterprises interviewed are willing to consider using RMB as the trade financing currency in their economic and trade exchanges with China.

The eighth largest foreign exchange trading currency

In 2019, global RMB foreign exchange transactions increased steadily. According to the latest data released by BIS in April 2019 (once every three years), RMB ranks eighth among the most active currencies in the world, and ranks first among the currencies of emerging market countries.

The global average daily trading volume of RMB increased from $202 billion in 2016 to $284 billion, and its share in the global foreign exchange market increased from 4% in 2016 to 4.3%.

Data map: The bank teller is working. Photo by Ai Qinglong

RMB assets are becoming more and more popular.

According to the report, by the end of 2019, the amount of domestic financial assets such as RMB stocks, bonds, loans and deposits held by overseas entities totaled 6.41 trillion yuan, a year-on-year increase of 30.3%. Among them, the stock market value is 2.1 trillion yuan, the bond custody balance is 2.26 trillion yuan, the deposit balance is 1.21 trillion yuan (including interbank current account deposits), and the loan balance is 833.2 billion yuan.

Stocks and bonds in domestic financial markets have become the main varieties for overseas entities to allocate RMB assets. By the end of 2019, the scale of domestic RMB stocks and bonds held by overseas entities increased by 48.6% year-on-year, of which the amount of bond custody accounted for 2.3% of the total bond custody in the inter-bank bond market, and the market value of stocks held accounted for 3.6% of the total market value of A shares. In 2019, stocks accounted for 66.6% of the domestic RMB assets newly added by overseas entities.

In other words, more and more foreign investors are looking for gold in China’s capital market. In 2019, the cross-border receipts and payments of securities investment in RMB totaled 9.51 trillion yuan, up 49.1% year-on-year, with a net inflow of 621.9 billion yuan.

More foreign trade enterprises use RMB for cross-border payment and receipt.

According to the questionnaire of the People’s Bank of China on foreign trade enterprises, since 2019, foreign trade enterprises have been highly motivated to participate in cross-border RMB business. As of the fourth quarter of 2019, 84.6% of enterprises chose RMB as the main currency for cross-border settlement.

Judging from the driving factors for enterprises to choose cross-border RMB settlement, since 2019, due to the influence of external factors such as Sino-US trade friction, RMB exchange rate fluctuations have increased. Many enterprises choose cross-border RMB business as a means to avoid exchange rate risks, accounting for 64.7%. In addition, simple settlement process, reducing settlement cost and facilitating financial accounting and fund management are also the main reasons why enterprises choose to carry out cross-border RMB business, accounting for 43.2%, 36.8% and 32% respectively.

The RMB cross-border payment system (CIPS) has become the main channel for RMB cross-border settlement. In 2019, the CIPS system handled 1.884 million cross-border RMB businesses, amounting to 33.9 trillion yuan, up 31% and 28% respectively. It handled 7,537 transactions daily, with an amount of 135.7 billion yuan.

Data map of RMB. China News Service reporter Zhang Hao photo

Iron ore transactions are settled in RMB.

In recent years, China has been the largest importer and consumer of iron ore trade in the world. The import and consumption of iron ore are at the global level of 70% and 50% respectively, but it has been relatively passive in pricing.

Nowadays, domestic iron and steel enterprises have made continuous progress in using RMB to settle iron ore imports. In early May 2020, baoshan iron & steel, a subsidiary of China Baowu Group, and Rio Tinto completed the first cross-border RMB settlement with blockchain technology. This is another new development after baoshan iron & steel completed the first RMB cross-border settlement with Brazil’s Vale and Australia’s BHP Billiton in January and April this year respectively.

So far, China Baowu and the world’s three major iron ore suppliers have achieved RMB cross-border settlement, totaling more than 500 million yuan.

The RMB exchange rate remained basically stable.

At the beginning of August 2019, due to the further escalation of trade friction, the RMB exchange rate was "broken by 7" driven by market forces, but the exchange rate expectation remained stable on the whole. Since then, due to the changes in the international economic and financial situation and the trade friction situation, the RMB exchange rate has broken by 7 for many times.

The report pointed out that in general, cross-border capital flows and foreign exchange supply and demand were basically balanced in 2019, exchange rate expectations were generally stable, and the RMB exchange rate remained basically stable at a reasonable and balanced level.

Overall, in 2019, the domestic RMB exchange rate fluctuated in both directions, and its flexibility was significantly enhanced. The RMB has risen and fallen against the US dollar and other major currencies in the world. The central parity of RMB against the US dollar, Japanese yen and British pound has depreciated by 1.62%, 3.43% and 5.18% respectively compared with the end of 2018, and the central parity of RMB against the euro has appreciated by 0.41% compared with the end of 2018.

Renminbi and US dollars. Zhongxin. com reporter Li Jinlei

Raise the level of free use of RMB

According to the report, RMB internationalization is a natural process driven by the market. In recent years, the cross-border use of RMB has maintained rapid growth, especially since the COVID-19 epidemic hit global trade, finance and economy this year, the cross-border use of RMB has remained resilient and showed growth.

The Bank of China said that in the future, it will continue to serve the real economy, adhere to the principle of marketization, and steadily promote the internationalization of RMB.

First, adhere to market-driven. Explore and promote a higher level of trade and investment facilitation, constantly remove obstacles restricting the use of RMB at home and abroad, and create a level playing field for RMB and other major convertible currencies. Second, continue to promote the opening of domestic financial markets and the interconnection of infrastructure. Further facilitate foreign investors to use RMB to invest in domestic bonds and stocks. The third is to guide the healthy development of the offshore RMB market. Improve the freely usable level of RMB and promote the benign interaction and deep integration between offshore and onshore markets. The fourth is to improve macro-prudential management. Strengthen the monitoring, analysis and early warning of cross-border capital flows, make countercyclical adjustments, and guard against the risks of cross-border capital flows. (End)