Netease Cloud Music is caught in traffic anxiety and has cooperated with Tencent for many years to survive?

Author: Pan Yan

Produced by: Global Finance Theory

On May 26th, the share price of Netease Cloud Music ushered in a wave of surge, which once reached HK$ 92.55, up over 57%. In the end, Cloud Music closed at HK$ 81.1, an increase of 38.16%, which was the highest increase in one day since Netease Cloud Music went public in Hong Kong.

The sudden surge is related to the sudden handshake between Netease and Tencent, which have been "entangled" for many years.

After years of entanglement, make peace?

As early as 2014-2015, Tencent Music, with its deep pockets, pocketed many copyrights such as YG Entertainment, Jewel, Huayi, Emperor, Lehua and Huayan International, and even its own "brother" WeChat banned similar online music products such as Netease Cloud Music, Xiami Music and Everyday Music, and the copyright dispute officially started.

In this incident, Netease also issued a message called "Goodbye, Friends Circle; Chang Bo of Hello, Good Music insinuates that Tencent has no open Internet spirit.

Image source: Weibo

In 2018, under the impetus of the National Copyright Administration, Tencent Music and Netease Cloud Music exchanged copyrights. Since then, although the struggle between the two families is not as fierce as before, there are still many confrontations in the open and in the dark.

In July 2021, the State Administration of Market Supervision ordered Tencent Music to terminate the exclusive copyright agreement. Netease Cloud subsequently issued a notice saying that it firmly supported the punishment decision of the State Administration of Markets.

Since Netease Cloud first posted a blog in February 2021 accusing Cool Dog Music of plagiarism, in April this year, Netease Cloud again issued a statement announcing the prosecution of Tencent Music Entertainment Group (including QQ music, cool music, cool dog music, national K songs and other products) for copyright infringement through illegal broadcasting and unauthorized songs, batch impersonation, product innovation by copying, evasion and even confrontation with supervision, which constitutes unfair competition.

Image source: Netease Cloud WeChat official account

Subsequently, Chen Mo, the head of brand public relations of Tencent Music Entertainment Group, responded in a circle of friends, saying, "Ignoring the facts to touch porcelain will not help the development of the music industry, and it will not join the ranks of quarrelling. Relevant evidence has already been preserved, and the lawsuits initiated have already been initiated one after another."

At the same time, the black history that Netease Cloud Music illegally packaged and sold Jay Chou Quanqu Library was also dug up by the people who ate melons.

Just as the public was still immersed in the copyright dispute between Netease and Tencent, the two companies suddenly sent a message to "confess" each other.

On May 25th, Netease Cloud Music officially announced that WeChat status can support one-click sharing of Netease Cloud Music. WeChat official account, its official WeChat, also published an article entitled "Thank you for your status on WeChat", which introduced in detail all the steps to share the songs in Netease Cloud Music to "WeChat status".

At the same time, WeChat’s official account "WeChat School" also responded with "@ Netease Cloud Music Thank You for Your Song".

Or related to the new function of WeChat status, Netease Cloud Music increased by 38.16% on May 26th. As of the close of June 1, Netease Cloud Music reported 86.65 Hong Kong dollars/share, with an increase of over 50% in five trading days.

One second, it was full of gunpowder, and the next second, it was quiet. Perhaps it is the old saying, "There are no eternal enemies, only eternal interests".

Stock competition continues, user growth touches the ceiling.

With the advent of the post-copyright era, the online music market has entered the stage of stock competition and is facing the loss of users.

According to Analysys Qian Fan’s "Annual Comprehensive Analysis of Online Music Market in China in 2022" report, in January 2022, all mobile music users spent 21 minutes per day, down 21% year-on-year; All mobile music users started 4.2 times per day, down 21% year-on-year.

Netease Cloud Music, which once suffered from "the pain of copyright", has also begun to accelerate copyright cooperation, and has successively added copyright parties such as Modern Sky, Emperor Entertainment and Lehua Entertainment. However, this also brings a lot of cost pressure to the company.

From 2018 to 2021, the service cost of Netease cloud music content was 1.971 billion yuan, 2.853 billion yuan, 4.787 billion yuan and 6 billion yuan respectively. Among them, this cost has exceeded the total revenue of each period from 2018 to 2019, and reached 97.79% of the total revenue in 2020.

"Promoting the incubation of independent musicians and the development of self-made music" is one of the strategies that Netease Cloud Music has adhered to for many years.

Behind a number of support programs for independent musicians, we can see the thinking of Netease Cloud Music. Through the vigorous development of the original music ecology, we can get rid of the shackles of copyright, which is also Netease Cloud Music’s efforts to reduce costs.

However, originality is not obvious for Netease Cloud Music to quickly seize market share.

Netease Cloud Music Prospectus revealed that according to the revenue in 2020, Tencent Music accounted for 72.8% of the market share, and Netease Cloud only accounted for 20.5%. In 2020, Tencent’s music revenue has reached 29.15 billion yuan, while Netease’s vowel music revenue scale is 4.9 billion yuan.

In addition, Netease Cloud Music has been at a loss for nearly four years. From 2018 to 2021, Netease Cloud Music lost 1.72 billion yuan, 1.64 billion yuan, 1.52 billion yuan and 2.056 billion yuan respectively.

According to the latest first-quarter financial report, Netease Cloud Music’s loss has narrowed, with an adjusted net loss of 152 million yuan, which is 46.6% narrower than that in 2021.

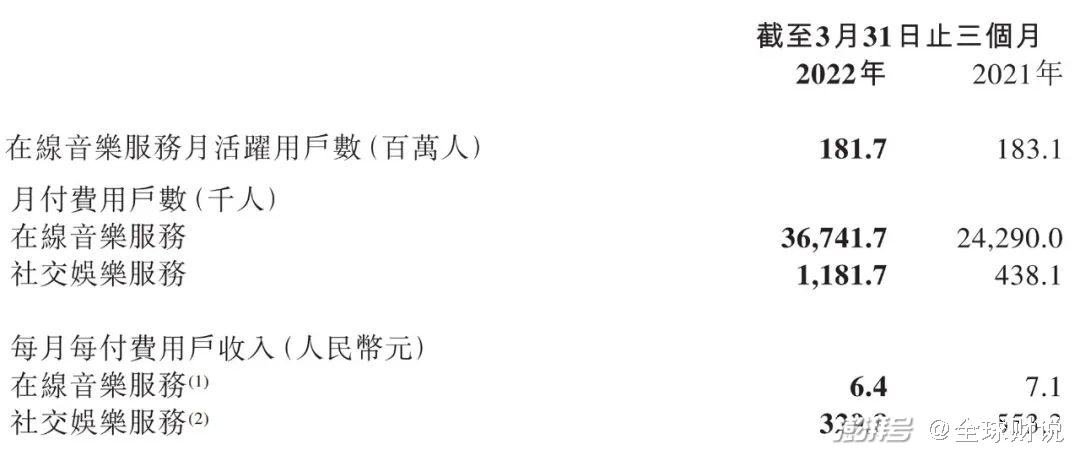

Although the net loss has narrowed, Netease Cloud Music’s monthly revenue per paid user (ARPPU) is decreasing. Among them, the social entertainment service ARPPU, the core business of Netease Cloud, dropped from 553.3 yuan in the first quarter of 2021 to 329.8 yuan in the first quarter of 2022, while the online music service ARPPU dropped from 7.1 yuan to 6.4 yuan.

In addition, the monthly activity of Netease Cloud Music has also decreased. The monthly active users of online music service decreased from 183.1 million in the first quarter of 2021 to 181.7 million in the first quarter of 2022.

Image source: Netease Cloud Music Quarterly Report

The lack of user growth and the decline of payment ability have become a common problem faced by the online music industry.

For example, Tencent Music, although the monthly user scale far exceeds Netease Cloud Music, has also experienced a year-on-year decline for eight consecutive quarters, which means that the growth of Tencent Music is gradually slowing down. In the first quarter of 2022, the number of monthly users of Tencent Music’s online music service decreased by 1.8% year-on-year to 604 million.

At the same time, the ARPPU of Tencent Music’s online music has also declined for five consecutive quarters. In the first quarter of 2022, the online music ARPPU of Tencent Music was 8.3 yuan/month, down 10.8% compared with the same period of last year.

Old players meet new Meng

Today’s online music market may usher in a new pattern.

This change is mainly reflected in the shift of the balance center of gravity between the major platforms for "copyright, users and musicians". That is to say, in addition to competition with each other, online music platforms have different weights for copyright, users and musicians.

Today’s online music platform is either merged like "QQ Music+Cool Dog Music+Cool Me Music" or exited like Xiami Music. But on the whole, the platform that survives today is larger, the competition is more concentrated than before, and it also faces the pressure of new players with strong backgrounds.

Different from the old players such as Netease Cloud Music and Tencent Music, new players such as Tik Tok and Aauto Quicker rely on their huge platform traffic to enter the market.

With the continuous popularity of "Tik Tok Hot Songs" and "Aauto Quicker Divine Comedy", the short video platform has more and more mastered the right to speak the current "hot songs", and the musical ambitions of Tik Tok and Aauto Quicker are far more than that.

Taking ByteDance as an example, following the launch of the first music APP "Soda Music" in 2021, an APP named "Sponge Band" was recently launched. According to the official introduction, this product will better serve "soda music" and users who need music editing in Tik Tok.

But the most direct impact is that many music copyright companies now take short video platforms such as Tik Tok as the first choice for the promotion of new songs, which is nothing more than another big crisis for old players.

From this point of view, with players such as short video platforms and live broadcast platforms entering the music track, it is more wise for Tencent Music and Netease Cloud Music to join hands to resist foreign enemies than to continue to hurt each other.

For Netease Cloud itself, with the help of WeChat status and circle of friends, reaching more users and playing a role of drainage and promotion, why not? Shake hands and make peace is also a way to survive.